Global hiring

made easy

Hire global professionals compliantly, without the need to set up a foreign entity.

We can help you find, hire, manage, and pay top

tier professionals worldwide with easily scalable

global hiring solutions, tailored to your needs with our Employer of record (EOR) services.

Explore Our Global Hiring Services

Discover how we help companies expand quickly and compliantly through our full suite of services, from global hiring and recruitment to contractor management and immigration support.

![]()

Employer of Record

Hire talent in Latin America and beyond without setting up a local entity.

![]()

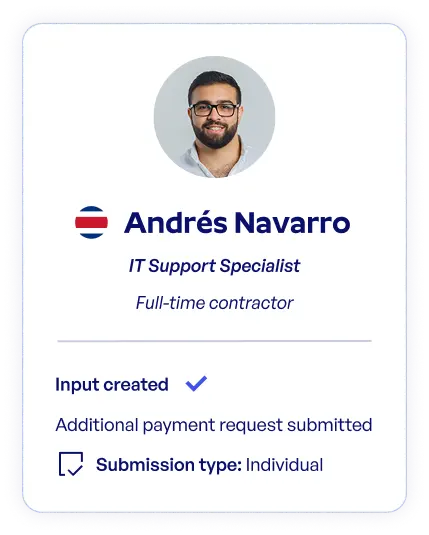

Contractor of Record

Hire worldwide contractors with legal compliance and cost-effectiveness.

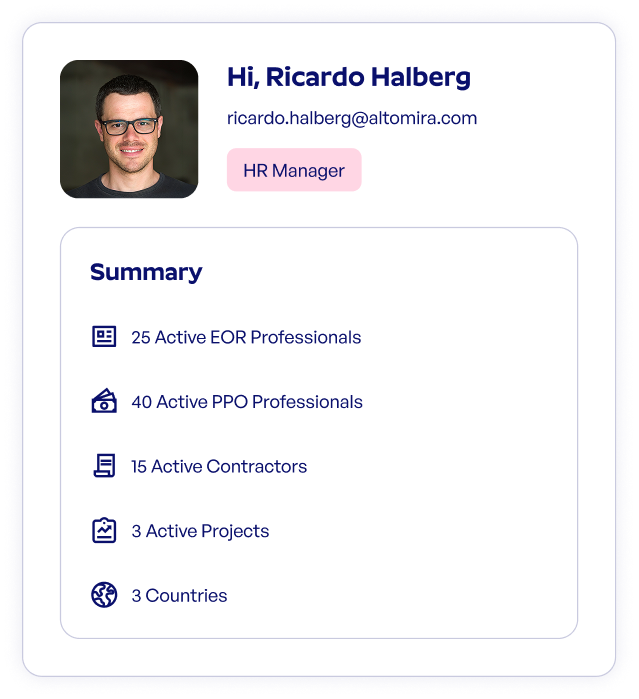

Simplified global HR management

Serviap Global Hub is the latest advancement in our suite of HR management solutions, designed to make monitoring and managing your international workforce easier than ever.

Easily manage teams and projects from anywhere with just a few clicks, ensuring efficiency and convenience.

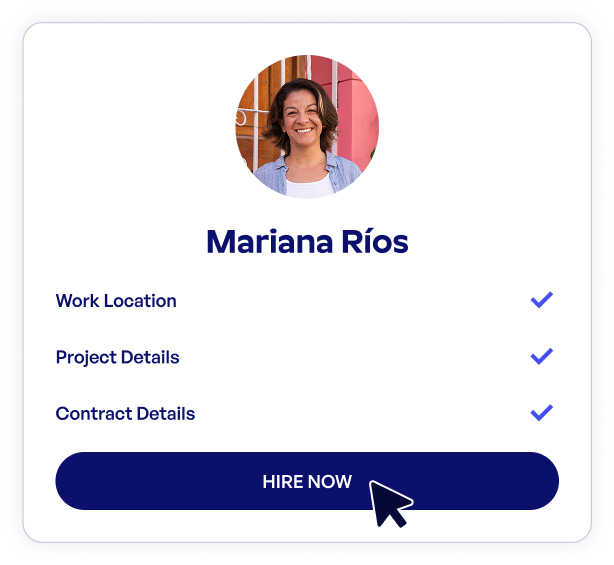

Borderless staffing without a foreign entity

When you hire us as an employer of record (EOR), we hire international professionals on your behalf and take care of their onboarding and administration, including their payroll and all relevant compliance matters. That means you don’t need a local entity or to worry about unfamiliar regulations.

Hire top professionals for projects

Contractor of Record can be very cost-effective, but its crucial to make sure they are working under specific conditions.

Learn how to manage contractor misclassification risk.

Discover where you can grow with Serviap Global

Your one-stop solution to

hiring staff overseas.

Premium support

No matter how big or small, we are ready to answer all your questions — anytime, anywhere.

Regional expertise

We have in-country experts to help you navigate new markets and cultural nuances anywhere you want to do business.

Top-tier benefits packages

Great talent deserves great benefits. We can help you offer a competitive range of benefits to attract top-tier talent worldwide.

Guaranteed compliance

We will make sure that all local laws and regulations are properly implemented, so you will have nothing to worry about.

Trusted By Businesses Worldwide

Recognized For Excellence, Driven By Our Clients Success

Brandon Hall Award (Winner)

This award recognizes our exceptional achievements in HR solutions.

Remote Tech Breakthrough Awards (Winner)

This award recognizes our commitment to excellence and innovation in global services.

Global Payroll Awards (Nominated)

This nomination honors our support to payroll professionals worldwide.

2025 Excellence in Customer Service Awards (Winner)

This recognition shows our team’s commitment to excellent customer experiences.

Recognized For Excellence, Driven By Our Clients Success

Brandon Hall Award (Winner)

This award recognizes our exceptional achievements in HR solutions.

Remote Tech Breakthrough Awards (Winner)

This award recognizes our commitment to excellence and innovation in global services.

Global Payroll Awards (Nominated)

This nomination honors our support to payroll professionals worldwide.

2025 Excellence in Customer Service Awards (Winner)

This recognition shows our team’s commitment to excellent customer experiences.

215+

Companies trust us to drive their borderless success

180+

Countries and territories covered with our global solutions

4.7/5

Client satisfaction. Your success is our priority

10,000+

Pre-vetted candidates, ready to hire

Frequently Asked Questions

1. What is an Employer of Record (EOR) and how does Serviap Global work?

An Employer of Record (EOR) is a partner that becomes the legal employer of your international team, while you keep full control of their day-to-day work. Instead of opening legal entities in multiple countries, you hire through Serviap Global. We handle locally compliant contracts, onboarding, payroll, benefits, and offboarding, while you manage performance, culture, and strategy. This model lets you test new markets, hire niche talent abroad, or scale remote teams quickly without long setup times or costly entity formation. With Serviap Global, you access a single partner for EOR, global payroll, and HR support across 180+ countries.

2. In which countries can Serviap Global support our hiring and payroll needs?

Serviap Global helps you hire and manage talent in more than 180 countries across Latin America, North America, Europe, and Asia–Pacific.

Through our network of in-country experts and entities, we can support full-time employees via EOR, as well as recruitment, contractor management, and payroll outsourcing in key global markets. If you already have local entities, we can run payroll and ensure compliance for those employees too. If you do not, we act as your EOR so you can start hiring in days instead of months. Our team will confirm coverage for specific roles, locations, and headcounts during your initial consultation.

3. When does it make sense to use Serviap Global instead of opening our own entity?

Using Serviap Global as your EOR is ideal when you want to hire in a new country quickly, test a market, or build a small to mid-sized team without committing to a local subsidiary. Setting up an entity can take months and require significant legal, tax, and HR investment. Leading global EOR providers help companies bypass that complexity while staying fully compliant.

With Serviap Global, you can hire a single specialist or a full team, validate the market, and then decide whether to keep using EOR, transition to your own entity, or combine both. Our experts can advise you on the right moment to switch based on cost, risk, and long-term strategy.

4. How does Serviap Global manage local compliance, taxes, and employee benefits?

Compliance is at the core of our service. As the legal employer in each country where we operate, we take responsibility for adhering to local labor laws, tax rules, social security, and statutory benefits.

Our in-country specialists design locally compliant employment contracts, calculate and process payroll, manage mandatory contributions, and administer country-specific benefits such as paid leave, 13th-month salary, or severance where applicable. We can also help you offer competitive, market-aligned benefits to enhance talent attraction and retention. Throughout the relationship, we monitor regulatory changes and update your employees’ payroll and documentation so your organization can focus on growth, not on keeping up with legal details.

5. How much do EOR, payroll, and recruitment services cost with Serviap Global?

Pricing depends mainly on the country, type of service (EOR, global payroll, or recruitment/RPO), and the number and seniority of the roles you need to fill. Most global EOR providers charge a per-employee, per-month fee for EOR services, while payroll outsourcing and recruitment projects follow tailored pricing structures.

At Serviap Global, we build transparent proposals that clearly separate fixed monthly fees, any one-time setup costs, and optional add-ons, so you understand your total cost of global hiring before you start. Share your target countries and headcount with us, and we will provide a customized quote that you can compare against the cost and timeline of opening your own entity.