Table of Contents

Colombia enters 2026 with major labor law changes that directly affect employers, particularly those managing payroll, work schedules, and employment contracts. Unlike simple annual adjustments, Colombia’s labor reform introduces structural changes that become fully effective during 2026.

For companies hiring or employing talent in Colombia — including foreign employers — these updates require careful compliance planning, as they impact labor costs, workforce flexibility, and operational models.

This article outlines the confirmed Colombia labor law changes effective in 2026 and explains what employers should review to remain compliant.

Why 2026 Is a Key Year for Employers in Colombia

Colombia’s labor reform follows a phased implementation, meaning several provisions approved earlier now become enforceable in 2026.

Key areas impacted include:

- Employment contract structure

- Reduction of the standard workweek

- Expansion of night shift hours

- Minimum wage adjustments

- Payroll and social contribution calculations

Together, these changes significantly affect employment planning and total labor cost.

For companies without a local entity in Colombia, these changes can be particularly challenging to manage internally. In these cases, working with an Employer of Record (EOR) allows companies to stay compliant with local labor laws while outsourcing employment administration, payroll, and statutory obligations.

Employment Contracts: Indefinite Contracts as the Default

One of the most significant labor law changes is the shift toward indefinite-term contracts as the default employment model.

What changes in 2026

- Fixed-term contracts are limited in duration and renewals.

- Repeated renewals may be interpreted as indefinite employment.

- Employers must justify the use of temporary or fixed-term agreements.

Employer impact

- Reduced flexibility for short-term hiring

- Higher exposure to termination-related costs

- Greater importance of contract drafting and probation periods

Employers should review existing contract structures to ensure they align with current enforcement standards.

Reduction of the Workweek to 42 Hours

Colombia continues its gradual reduction of the standard workweek, reaching 42 hours in July 2026.

Key points

- Salaries must remain unchanged despite the reduced hours.

- Employers must redistribute hours across working days.

- Overtime thresholds are reached more quickly.

This change has a direct impact on operational scheduling, productivity planning, and overtime costs, especially for service and support teams.

Night Shift Starts Earlier: Payroll Cost Impact

Another relevant change affects night work definitions.

Effective rule

- Night shift is defined as work performed from 7:00 p.m. to 6:00 a.m.

Employer implications

- Increased payroll costs due to night shift surcharges

- Greater complexity in scheduling

- Higher impact for companies operating extended or global hours

This change is particularly relevant for call centers, shared services, and international operations.

Minimum Wage Increase and Payroll Adjustments in Colombia (2026)

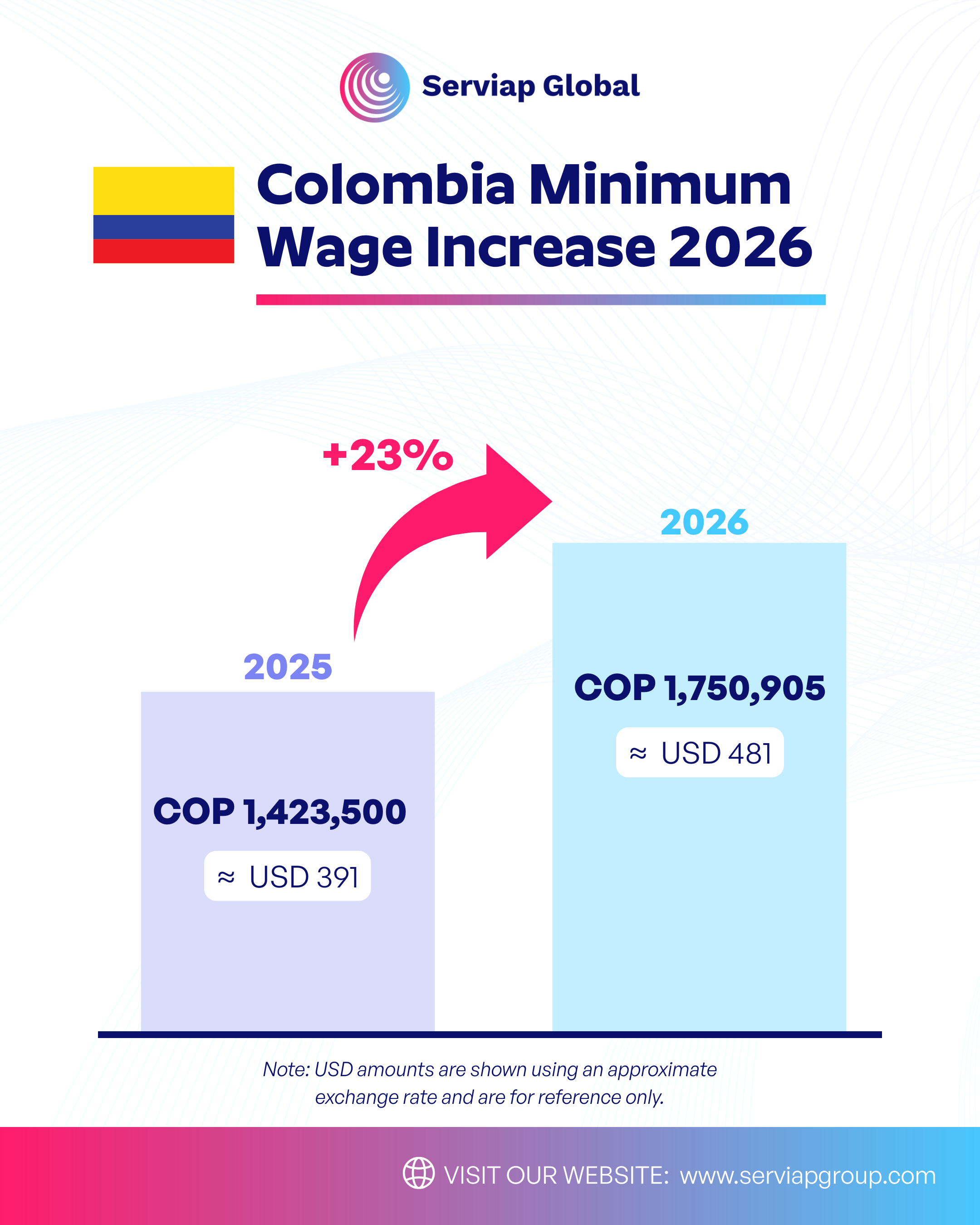

As of January 1, 2026, Colombia implemented a new national minimum wage (Salario Mínimo Legal Mensual Vigente – SMLMV).

For 2026, the official minimum wage is:

- COP $1,750,905 per month (base minimum wage)

- COP $249,095 per month (mandatory transportation allowance for eligible employees)

This represents a 23% increase in the base wage compared to 2025, making it one of the largest minimum wage increases in LATAM for 2026.

What this means for employers

Even for employees earning above the minimum wage, this increase affects:

- Social security contributions (health, pension, occupational risk)

- Overtime and night shift calculations

- Statutory benefits linked to wage thresholds

- Total employment cost forecasting

Payroll systems and employment contracts should reflect these values from January 2026 onward.

Telework and Connectivity Allowance

Employers with remote or telework arrangements must also comply with connectivity allowance requirements.

- Employees earning up to two minimum wages are entitled to a connectivity allowance.

- This replaces transportation subsidies for eligible remote workers.

Proper classification and payroll treatment are essential to remain compliant.

Key Compliance Actions for Employers in 2026

Companies employing or hiring in Colombia should review:

- Employment contract types and renewal practices

- Work schedules aligned with the 42-hour workweek

- Payroll systems reflecting new night shift definitions

- Overtime and surcharge calculations

- Remote work benefits and allowances

For foreign companies, local interpretation and ongoing monitoring are often required.

As compliance requirements become more complex in 2026, many international employers rely on local experts or an Employer of Record to ensure payroll accuracy, contract compliance, and ongoing regulatory monitoring.

Hiring or employing in Colombia in 2026?

Colombia’s labor law changes impact employment structure, payroll costs, and compliance obligations. For foreign companies, keeping up with these requirements can be complex without local expertise.

Learn how an Employer of Record (EOR) in Colombia can help you hire and manage talent compliantly, without setting up a local entity.

Frequently Asked Questions (FAQs)

What is the minimum wage in Colombia for 2026?

The minimum wage is COP $1,750,905 per month, plus a mandatory transportation allowance of COP $249,095 for eligible employees.

Does the 42-hour workweek reduce salaries?

No. Salaries must remain unchanged despite the reduction in working hours.

When does night shift start in Colombia?

Night work is defined as work performed from 7:00 p.m. onward, triggering night shift surcharges.

Do these changes apply to remote employees?

Yes. Employers must review connectivity allowances and payroll treatment for remote workers.

Can foreign companies hire in Colombia without a local entity?

Yes. Companies can hire through an Employer of Record (EOR), which manages contracts, payroll, and compliance locally.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

Let us improve this post!

Tell us how we can improve this post?