- Global Hiring EOR

- Central America

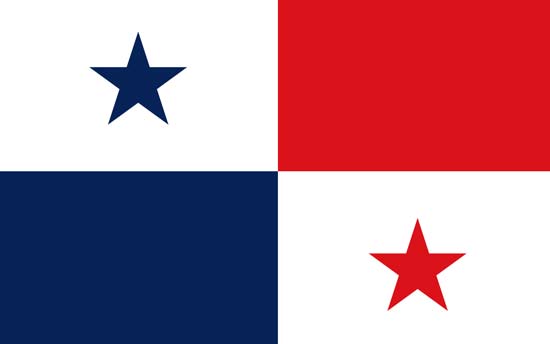

Employer of Record Services in Panama

Expanding your business in Panama can be a challenging step and that’s why getting information about the country, and its laws, will be of great help.

How we can help you expand in Panama

Hire in Panama with confidence – stay compliant, move fast, and keep full control of your team without setting up a local entity.

If you are expanding into Panama, the fastest way to onboard talent while reducing legal and payroll complexity is to use an Employer of Record (EOR). This page explains how the model works, the key compliance considerations, and what to expect from implementation – so you can make a decision and start hiring.

Table of Contents

What is an Employer of Record (EOR) in Panama?

An Employer of Record is a service that hires employees on your behalf through a local, compliant employer entity. The EOR becomes the legal employer in Panama for payroll, statutory benefits, and labor documentation, while your company directs the employee’s daily work, goals, and performance. This approach helps international teams expand quickly without taking on the overhead of entity setup.

How the EOR model works in Panama

With an EOR, you can hire employees in Panama without a local entity. Your team stays integrated into your business, but the local employment relationship is managed through the EOR so you can operate with a compliant foundation from day one.

The EOR typically manages:

- Employment contracts and mandatory policy acknowledgements

- Payroll processing, withholdings, and payslips

- Statutory benefits and required employer contributions

- Onboarding, offboarding, and ongoing HR administration

You keep control of compensation decisions, job scope, and reporting lines. The EOR handles the compliance framework, documentation, and recurring administration.

This setup is especially useful when you are testing the market or hiring your first roles. It gives your team a compliant local foundation while you keep your global policies and culture consistent.

Key benefits for international employers

Working with a Panama Employer of Record provider is a practical way to reduce risk while increasing speed to hire. You can build a local presence in Panama without committing to entity maintenance and administrative overhead.

- Launch faster: hire in weeks, not months.

- Reduce compliance burden: contracts, payroll, and statutory benefits handled locally.

- Improve the employee experience: clear onboarding, local-language support, and predictable pay cycles.

- Stay flexible: scale hiring as business needs change.

- Centralize reporting: one point of contact for HR operations and payroll insights.

Country employment snapshot

Below is a high-level snapshot to guide planning. Requirements can vary by role, industry, and policy updates, so always validate specifics with local counsel.

Item | Typical expectation (verify for your case) |

Currency | Panamanian balboa (PAB) and US dollar (USD) |

Payroll frequency | Commonly bi-weekly or monthly |

Typical workweek | Often 40-48 hours, depending on schedule |

Minimum paid vacation | 30 calendar days per year after eligibility |

Public holidays | Multiple paid holidays each year; calendar varies |

13th month salary | Mandatory in many employment arrangements; often paid in installments |

Social security | Employee and employer contributions apply; rates may change |

Termination & severance | Notice, cause, and final settlement rules may apply |

Legal verification note | Confirm with local counsel |

Compliance & risk

Expansion is smoother when you treat compliance as a system, not a one-time checklist. Panama labor law compliance for foreign companies usually comes down to preventing the most common operational risks.

- Worker misclassification and blurred roles between contractor and employee

- Incomplete contracts, missing policies, or unclear probation terms

- Payroll errors, late payments, or incorrect statutory deductions

- Missed benefits accruals (vacation, leave entitlements, and required additional payments)

- Social security registration gaps or contribution miscalculations

- Offboarding mistakes that trigger disputes (final pay, documentation, notices)

- Weak privacy controls for HR documents and employee data

A well-run EOR mitigates these risks with standardized documentation, local payroll validation, and documented workflows for changes and terminations.

Payroll, taxes, and benefits management

Panama payroll and tax compliance is where most expansion projects slow down. The goal is not only to pay on time, but to align payslips, statutory deductions, and employer obligations to local expectations while keeping reporting simple for your finance team.

An EOR typically supports:

- Monthly payroll calculation and salary payments

- Statutory deductions and employer contribution administration

- Payslip generation and employee payroll communications

- Leave tracking inputs that affect payroll (vacation, sick leave, holidays)

- Benefits coordination aligned to your total rewards approach

Because obligations like social security and the 13th month payment can impact budgeting, it is best practice to validate total employer cost modeling before the first start date and to document the payroll calendar clearly.

Contractor vs employee classification in Panama

Contractor vs employee classification Panama should be assessed case-by-case. Misclassification risk often starts with speed: you engage a contractor, but the relationship operates like employment (fixed hours, direct supervision, core business duties, and long-term dependency).

If you need long-term, controlled work, an EOR employment contract is typically the safer route. If you truly need an independent service provider, use a compliant contractor agreement and keep the relationship outcome-based rather than hours- and process-based.

Pricing & implementation

Most EOR engagements use a predictable monthly fee per active employee. EOR cost in Panama per employee depends on factors like role seniority, payroll complexity, benefit elections, and start-date urgency.

What pricing commonly includes

- Local employment contract preparation and onboarding paperwork

- Monthly payroll processing and statutory filings support

- Employer contributions administration and payment coordination

- Employee lifecycle support (role changes, leave handling, offboarding)

Typical implementation timeline

Timeline | What happens |

Weeks 1-2 | Role scoping, compensation design, document collection, draft contract |

Weeks 3-4 | Sign contract, complete registrations, finalize payroll readiness for first cycle |

Contact Us | Request a Panama hiring quote with an implementation timeline.

Step-by-step: hiring through our EOR

- Define the role, location, and target start date.

- Validate compensation and benefits against market norms.

- Collect new-hire documents and run eligibility checks.

- Issue the compliant local contract for signature.

- Complete onboarding and payroll registration steps.

- Run first payroll and confirm payslip accuracy.

- Ongoing HR operations and compliance monitoring.

Compare options: EOR vs PEO vs Local entity

Choosing the right model depends on speed, risk appetite, and how much administrative work you want to own. Use the comparison below to align stakeholders on the best route for Panama.

Option | Pros | Cons | Best when |

EOR | Fast setup; no local entity required; compliance handled locally | Per-employee monthly fee; less direct ownership of employer entity | You need speed and compliant hiring without incorporation |

PEO | HR support model for companies with an entity; shared HR processes | Usually requires your entity; co-employment model can vary | You already operate locally and want HR outsourcing |

Local entity | Maximum control over employment relationship and operations | Setup time, legal/accounting overhead, ongoing maintenance | You plan significant scale and long-term footprint |

Use cases: practical examples

- Sales expansion: hire an account executive and customer success support quickly.

- Professional services: onboard a bilingual project manager for nearshore delivery.

- Regional hub: build a small Panama team to coordinate Central America operations.

- Specialized talent: recruit finance, operations, or technical roles with compliant payroll.

Best practices and common mistakes to avoid

Best practices

- Standardize role leveling and compensation ranges before you hire.

- Document working hours, leave approvals, and expense rules from day one.

- Use a structured onboarding plan with tools, access, and training milestones.

- Review classification, contract terms, and data handling before the start date.

Common mistakes

- Using contractors for roles that function like employees.

- Underestimating payroll complexity and budgeting for statutory obligations.

- Skipping documentation for terminations, transfers, or compensation changes.

- Treating compliance as a one-time task instead of an operating system.

Why choose us

EOR onboarding and HR administration in Panama works best when your provider combines local execution with a global operating mindset. We focus on clear milestones, practical risk control, and a great employee experience.

- Dedicated onboarding coordinator with a documented checklist and timelines

- Payroll accuracy validation process and proactive issue resolution

- Local-language employee support with clear escalation paths

- Standard templates for contracts, policies, and employment changes

- Ongoing guidance that scales with your hiring roadmap

Trust builders

- Transparent onboarding responsibilities (who does what, and when)

- Multi-step payroll validation before each payment run

- Change-management process for promotions, salary updates, and role changes

- Reporting-friendly summaries for HR and finance stakeholders

Ready to hire in Panama?

If you want to move quickly without sacrificing compliance, an EOR is often the most efficient path to build your Panama team. Share your target roles, start dates, and hiring goals, and we will map the fastest compliant route.

Contact Us | Start hiring in Panama with a clear plan and timeline.

FAQ’s

1. How fast can I hire an employee in Panama with an EOR?

Most companies can onboard talent in a matter of weeks once the role details and documents are ready. The timeline depends on how quickly compensation is approved, the employee completes paperwork, and payroll registration steps are finalized. An EOR helps reduce delays by providing contract templates, standardized onboarding checklists, and a clear cutover plan for the first payroll cycle. For urgent hires, the best approach is to align stakeholders on the start date and complete documentation early.

2. Do I need to open a legal entity to hire in Panama?

No. An EOR is designed to help you hire employees in Panama without a local entity. The EOR acts as the legal employer for local employment administration, payroll, and statutory benefits, while you manage daily work and performance. This model is useful for pilot hires, small teams, and expansion phases where you want speed and compliance without committing to incorporation, banking setup, and ongoing entity maintenance.

3. What does the EOR handle versus what my company controls?

Your company controls the employee’s responsibilities, goals, tools, and day-to-day management. The EOR handles the compliant employment layer: locally valid contracts, payroll processing, statutory deductions, required employer contributions, and HR administration tasks such as onboarding documentation and offboarding steps. This split keeps operational control with you while reducing legal and payroll complexity, especially when local requirements change or vary by situation.

4. How is payroll compliance managed in Panama?

Payroll compliance typically includes running salary calculations on schedule, generating payslips, applying the correct statutory deductions, and coordinating employer contributions. An EOR also tracks inputs that affect payroll, such as paid time off and leave events, and helps ensure employee communications are clear. Because rates, calendars, and policies can evolve, a best practice is to validate each payroll cycle locally and keep records organized for audits, reconciliations, and internal reporting.

5. Is it better to hire a contractor or an employee in Panama?

It depends on the working relationship. If you need long-term, supervised work that is core to your business, an employment arrangement is often the safer option. Contractor relationships should be outcome-based and independent, with the worker controlling how the work is performed. Misclassification can create legal and financial exposure, so it is important to assess the role before onboarding. An EOR is typically the best path when you want a compliant employee setup without opening an entity.

6. What factors influence the monthly cost of an EOR in Panama?

Pricing is usually a per-employee, per-month fee. The final cost can vary based on the number of hires, job seniority, payroll complexity, benefit elections, and how quickly you need to onboard. If your team requires additional HR support, custom reporting, or specific benefit coordination, that may also influence pricing. The most reliable way to budget is to request a quote that includes all expected statutory costs and a clear list of what services are included.

7. Can an EOR support terminations and offboarding in Panama?

Yes. A responsible EOR supports compliant offboarding steps such as documentation, final payroll settlement, and required notifications. Because termination rules can be fact-specific and may depend on cause, tenure, and contract terms, it is important to follow a consistent process. The best practice is to document performance issues, align on a termination plan in advance, and ensure final payments and required paperwork are handled correctly to reduce dispute risk.

8. What information do you need to start the EOR onboarding process?

To start, you typically need the role title, responsibilities, location, start date, compensation details, and benefit preferences. You will also share basic company information for contracting and invoicing, plus the employee’s identification details required for onboarding. Providing this information early helps the EOR prepare the local contract, schedule onboarding steps, and confirm payroll readiness. If you have a hiring roadmap for multiple roles, share it upfront so timelines and processes can be standardized.

Expand to Panama with Serviap Global

Through our PEO and EOR services, you can hire qualified talent in your industry without the trouble of opening your own legal entity. In just a few days, you can easily and safely build a presence in Panama, being sure that your staff will be hired in compliance with labor and tax regulations.

We offer end-to-end support in the following cases:

- You’ve already hired someone but your current provider is not giving you the service you need

- You hired a contractor and are not sure if you’re complying with local laws and regulations.

- You have one or more clients and are currently seeking to upgrade your service quality.

- You have a legal entity but can no longer afford a full operation.

- You have a temporary project or one that doesn’t require you to open a legal entity.

- You have a project that requires foreign talent.

- You are looking to expand your business and need a mix of local and foreign employees who know the local market and will help reduce the learning curve

- You are looking to expand your business with a partner that allows you to hire locally experienced employees

Get Started

Ready to get started?

Learn more about how we can help you establish a global presence with our PEO and EOR solutions.